So here is my current situation....

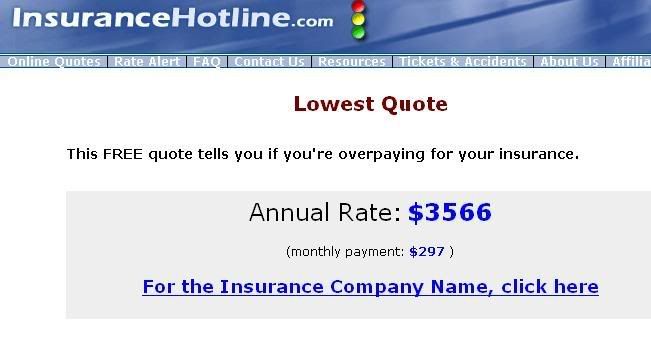

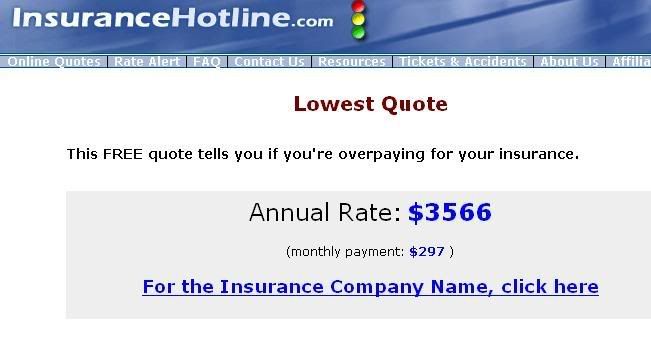

That is my most recent quote for my 1999 Cavalier z24. That quote is with no collision, comprehensive and $1 million liability.

I bought my car in September 2004. I am insured with Pilot insurance, and have been the whole time Ive owned my car. My policy is NO collision, $1 mil liability, plus comp.

My first year I forked out $339/month to insure it. Thats $4068 for the year. I was 18 at the time, and I just bit the bullet.

My second year, don't ask what happened, but I called them and they dropped it to $221/mon, basically $2652 for the year. Bearable, but still way to high.

My third year, which I am about half way through now, I am paying $260/mon, 3120 for the year.

Now I have 1 speeding ticket, it is a 15 over. My insurance company says it is not even on my record, and it has nothing to do with my policy. They said the premium increased from year 2 to 3 because of inflation and rising costs. That is complete horse crap.

I just don't understand how it can be so expensive, after 3 years of proving my responsibility.

Ontario sucks.

/rant

insurance is a big scam anyway.

I want to share something with you - the three sentences that will get you through life. Number one, 'cover for me', Number two, 'oh, good idea, boss', Number three, 'it was like that when I got here.'

insurance is a huge rip off i dont even have the z24 just a 2 door cavalier and i pay 250 a month liabilty one accident

Dalton promised he would help level out rates.. BUT he has not.. sigh. Hopefully things will change.

My Cav

My Cav

I give up...

i'm buying a VW those people love trees, so they should love eachother too... "Andy"

I'm surprised you got the rates that low for the past two years. Basically, insurance considers every male driver under the age of 25 a terrorist on wheels. After 25, things suddenly get much more reasonable. I've had the priviledge of staying on my parent's insurance as an "occasional driver" for as long as possible to keep the rates sane.

Shop Manuals, Brochures:

www.kenmcgeeautobooks.com

Move to Quebec, our rates are 1/3 of what you pay and we don't need yearly car inspections. When I was 17 I paid about (Am going from memory here) 1000$ a year in insurance, which went down to 500$ by the time I was 21. By the time I was 30 it was 75$ a year for TWO cars. A 1990 Ford Mustang and a 1975 Mercury Meteor. None of that was anything but basic insurance, but you still see the VAST difference between Ontario and Quebec. I live right next to the border so I hear horror stories about high premiums all the time.

No offense to the 'under parents name' thing, but are insurance companies that stupid? I have many friends who have their car, under their parents name, and save tons of money. Do the insurance companies nott see that there are 4-5 cars in that persons household? Clearly the kid is going to be driving one all the time.

Comparing all my friends who pay their own insurance, to those whose parents deal with it (or even pay their parents for having it under their name), I find that the ones who pay everything themselves are much more responsible with their car on the roads.

Is there any place we can send a letter or something to complain, I'm sure its been done before. I just don't comprehend how in Ontario is sucks so much, I mean you can't deny that Quebec drivers are much more careless, ect.

I just tried that same quote site, for Ontario insurance in my area. I'm 24 right now, at it quotes $2305 ($192/month) for my 1997 Cavalier. If I lie and say I'm one year older, it quotes $1488 ($124/month). Suffice to say, this is one area where I won't mind getting a little older. Maybe I'll be able to afford insurance on that WRX STI I want.

Shop Manuals, Brochures:

www.kenmcgeeautobooks.com

Geeky,

Where are you located in Ontario, I am 30 minutes East of Ottawa.

I figured at first, I would just bite the bullet. I still consider my 2nd year rates, of $221/month to be way to high. Especially with no collision.

I have a 17 year old friend who recently bought a 2000 Honda Civic SE, 2 dr., he is paying $196/month. To me it just doesn't make sense. It's not like I drive a corvette or anything.

I'm in Southwestern Ontario, town of Goderich. About an hour NW of London. Pretty rural, but that doesn't alway mean insurance is cheaper. Note also, I did include collision coverage in my quote. Besides region, the only other things that I can think might inflate your rates would be how far you commute/total annual milage, and perhaps whether you went through drivers ed.

Edited 2 time(s). Last edited Tuesday, March 20, 2007 9:42 AM

Shop Manuals, Brochures:

www.kenmcgeeautobooks.com

if i was the owner of my vehicle i would be paying around 6 grand a year. i am almost 21 with NO accidents or tickets. figure that one out. my insurance is under my parents name and its still a @!#$in rip off $235/mo.

I want to share something with you - the three sentences that will get you through life. Number one, 'cover for me', Number two, 'oh, good idea, boss', Number three, 'it was like that when I got here.'

I live just 15 minutes south east from goderich and am too with pilot. I had a 97 2dr cavalier, non z24 with no collision, $1 mil liability, plus comp. and I paid $308/month. Now I have 2002 4dr sunfire with no collision, $1 mil liability, plus comp. and now pay $320/month I'm 19. and did take drivers ed. The insurance company also said my ticket doesn't affect my insurance at all. I have had my full G for 2 years now. I too think this is bull@!#$.

1/4 Mile ET 15.2579 at 89.97mph

Quote:

No offense to the 'under parents name' thing, but are insurance companies that stupid? I have many friends who have their car, under their parents name, and save tons of money. Do the insurance companies nott see that there are 4-5 cars in that persons household? Clearly the kid is going to be driving one all the time.

Comparing all my friends who pay their own insurance, to those whose parents deal with it (or even pay their parents for having it under their name), I find that the ones who pay everything themselves are much more responsible with their car on the roads.

well said. its the truth.

im also insured with pilot, for my 2005 Z24 its almost $400 a month with no accidents. when i bought the car it was only $2 more a year over a dead base 2 door cav. how did they figure that one out???

http://registry.gmenthusiast.com/images/my2005cav/my%20car%20the%20bash.jpg

The J body gets hit hard because it has relatively bad crash ratings. My Monte is cheaper to insure. Even though it has far greater potential to get me in trouble and cost a fair bit more.

25 is a sweet number for drivers. Anyone under that is a "terrorist on wheels". lol

Be careful whene you are under your parents policy. If you screw up, you screw them too.

im 18 and i pay 2800 a year. i love ontario

Working on obtainting an M-Class license... ?? Hint: 2 wheels.

sounds like you all need to shop around for better rates

i got quotes from $210 - $400 for the same policy...just different companies

suffice to say i took the lowest one....thats with 2 tickets and 2 accidents as well

Phil Thacker

JCO North President

Hey guys.

Just thought i would throw this out there...I just switched companies from TD Insurance to Belairdirect in Toronto. The quote is for basic coverage only in the Barrie area and the rate is $175.50, for a total of $2106.00 a year. Not to bad considering it is $1100 cheaper then TD. Well worth the switch...

move to manitoba

my insurance is $1400 a year for full accident, 1mill liability, $200 deductible, auto loss of use, full wildlife coverage

somtimes i love public insurance

1998 Chevrolet Cavalier

5-spd

Manitoba Public Insurance or MPI for short, I pay $1135 a year for a 2001 sunfire with the same coverage as above.

I got a quote from belair direct online actually the other day, that was VERY cheaper..well comparing to what I, and others are currently paying. With collision it came to 2735/year (cheaper than my current rates without collision), and came to like 1900 without collision, i have recently sent an e-mail to my insurance broker. He e-mailed me back, asking me to call him in person.

I hear ya, with my 2 DR 03 Z24 my insurance was $355 a month with my G2, I got one ticket for running a stop sign and they didn't realise it until I told them I got my G license and it was suppost to be a significant drop after that right? nope it went up to $358 a month...I've gotten lower quotes (belair direct quoted me about 300 a month with $0 deductible and first accident forgiveness

) but I stayed with State Farm after too many horror stories of insurance companies that will drop you in an instant after your first claim costing them money. I live in Kitchener-Waterloo area.

Thanks to WannaBzee for the logo.

Z24 Reaper wrote:I hear ya, with my 2 DR 03 Z24 my insurance was $355 a month with my G2, I got one ticket for running a stop sign and they didn't realise it until I told them I got my G license and it was suppost to be a significant drop after that right? nope it went up to $358 a month...I've gotten lower quotes (belair direct quoted me about 300 a month with $0 deductible and first accident forgiveness  ) but I stayed with State Farm after too many horror stories of insurance companies that will drop you in an instant after your first claim costing them money. I live in Kitchener-Waterloo area.

) but I stayed with State Farm after too many horror stories of insurance companies that will drop you in an instant after your first claim costing them money. I live in Kitchener-Waterloo area.

State Farm used to drop anyone with even the slightest mod. I hope they have eased up a bit.

I'm in Ontario as well, don't take this the wrong way guys, but I'm 20 and drop EVERYTHING minus the mandatory Liability.

Lets face it, these are cavaliers and sunfires, whats the point in paying an extra thousand or so a year, with the odds of anything being stolen/your car being fubared, plus a $500 deductable, you're better off simply footing the bill if anything should happen to your car, it's cheaper. Remember, insurance companies are in these to make money.

Last year I payed $272 a month for LIABILITY ONLY and I was with Cowan, and underwritten by Pilot/Aviva, which I must say, handled my not-at-fault accident awesome, and gave me a cheque for my totalled 95 corsica really quick

However I've since switched to Bel-Air direct after Pilot wanting 323 a month for liability, I flat out basically told them to F-off.

I now pay 168 a month for liability through Bel-Air direct, couldn't be happier.

Also another thing that pissed me off when I was 17 I had a 1981 Camaro, with a 305 in it. I go to my insurance company, they charged me $172 a month, I go to switch to my god damned 2.2L 95 Corsica 4 Door automatic... rates go up to around 250. I said, what the hell, do you people not realise what car I'd be more likely to kill myself in? Ugh.

I have one ticket on my record for running a red (I still say it was a late amber, and a SHORT light) anyways... yes... insurance is a scam, but just shop around, someone will give you a totally BS rate, while others will give you a decent one... I know RBC wanted over 5k a year from me.

Oh, and I live in Kitchener-Waterloo, also... I go to college, so Bel-Air gives some sorta College/University discount.

There will always be someone faster than you, but thousands slower and dumber than you.

F-body Guy wrote:I go to my insurance company, they charged me $172 a month, I go to switch to my god damned 2.2L 95 Corsica 4 Door automatic... rates go up to around 250. I said, what the hell, do you people not realise what car I'd be more likely to kill myself in? .

I actually sent my broker a big e-mail the other day, asking questions concerning insurance. (i kept a very neutral tone and never made accusations)

he e-mailed me back asking me to call him at work. I did.

He said that the majority of insurance rates are based on crash tests. He said you could be driving a big ass SUV (broker is a cool guy) and your insurance would be much less. He said that its not the car with the chance to kill yourself in, its the car with a greater chance of surviving in. He said yes cavaliers are cheap cars, they are made cheaply, thus resulting in poorer crash test ratings. poored crash test ratings=more insurance

he was very helpful in the conversation, and although i have found a cheaper insurance rate, i will continue to give my money through him, here's why: my whole family is with him, house, autos ect, my grandparents are with him, from both sides of the family. He also said that my rates will go down to just under $2100/year if i do not get into an afault accident, or have any serious speeding infractions between now and september.

Like i said, I was very pleased with his service, and I value that.

Craig Lewis wrote:The J body gets hit hard because it has relatively bad crash ratings. My Monte is cheaper to insure. Even though it has far greater potential to get me in trouble and cost a fair bit more.

Likewise with the LS1 T/A.

My rates DROPPED when I went from the Z24 to the TA.

) but I stayed with State Farm after too many horror stories of insurance companies that will drop you in an instant after your first claim costing them money. I live in Kitchener-Waterloo area.